We’ll start with a look into the fascinating early years of Warren Buffett’s life, and then we’ll look into the top 3 key takeaways from The Snowball by Alice Schroeder.

From a modest thousand dollars in the 1940s, Warren Buffet has made over 110 billion dollars as of 2023 which is simply incredible.

His success is legendary, but what are the secrets behind this remarkable individual?

Exactly how is he among the most influential and respected investors ever?

These are questions we’ll uncover from the highly valuable book written by Alice Schroeder.

Throughout his childhood, Buffett looked for relief in analyzing numbers and statistics. He enjoyed school as he could escape his mother’s harsh discipline and find relief in his passion for mathematics. From a young age, he showed a great interest in probabilities and percentages, which many people considered strange.

Buffet’s unique fascination with numbers grew beyond his early childhood; by age nine, he started exploring entrepreneurial ventures. From selling sweets to offering nuts at sports games, he always looked for opportunities to profit.

One day at ten years old, his life would suddenly change as he discovered a book titled “One Thousand Ways to Make $1000”. Buffet grew curiosity with an idea he saw within the book to provide weighing machine services.

The business was simple as you receive money each time somebody used a weighing machine. Additionally, it was scalable as he could reinvest the profits from the first machine to purchase the second machine, and the next one should come in double the speed.

Buffett implemented this idea; however his business was in pinball machines instead of weighing machines. He bought his first pinball machine for 25 dollars in 1946 which is roughly the same as 400 dollars today.

Soon after he had multiple machines strategically located in barber shops. At only fourteen years old he had already completed a tax return and had saved up $1000. As his business grew, before turning 20, his business had earned him around $5000, which is roughly $80,000 today. Not bad for a teenager.

Buffet’s income grew in high school when he began delivering newspapers. His determination to collect subscription fees and his desire to run his pinball machines earned him a higher income than his teachers.

Buffett’s financial journey gained momentum in high school soon after he began newspapers. His commitment to collecting subscription fees and his entrepreneurial spirit earned him an impressive monthly income, surpassing even his teachers’ salaries.

His interest in making money and studying numbers grew throughout his student years so he enrolled in business and accounting. Although he was known as quite a messy and disorganized roommate, his exceptional memory set him apart academically. Despite being rejected by Harvard Business School, Buffet managed to enter Columbia University, where he’d be lectured by the famous investor Benjamin Graham.

While learning with Benjamin Graham, Warren Buffet started developing a curiosity and a greater understanding of the financial markets. Soon, he requested to work with Benjamin Graham for free to be mentored by him so he could learn about value investing.

Buffett quickly absorbed Graham’s teachings from his famous book ‘The Intelligent Investor’ and David Dodd’s ‘Security Analysis.’ A young, eager Buffett would regularly study these books to develop his investment philosophy and provide the foundation for his extraordinary wealth.

Key Idea 1: The Potential of Compounding

The book explains that a fundamental principle behind Buffet’s incredible wealth increase is the power of compound interest. In fact, he’s famously quoted as saying that his life has been a product of compound interest. He recognized the importance of compounding from an early age as it enabled him to grow his wealth since he purchased his first share in a company at 11 years old.

Eager to implement his knowledge from Ben Graham, in 1956, Buffet established a deal with friends and relatives who shared his principles. The investment fund was known as Buffett Associates Ltd, and the core investment idea was to find undervalued stocks. His approach would result in excellent stock market returns for his partners and boost his recognition as a skilled investor.

Key Idea 2: Understand your circle of competence

In 1965 Buffett moved on to purchase Berkshire Hathaway which helped him create to fortune he has today. Soon after buying the company, he faced many new challenges and opportunities. A massive challenge was the scandal following his involvement in American Express. He was able to deal with the scandal partly because he stuck to his circle of competence and understood the industry.

His discipline in sticking to his circle of competence has been a key contributor to his success. Despite his huge wealth and fame, he remains humble to recognize the limitations of his knowledge and only focuses on areas where he has expertise.

Thoroughly understanding an industry helps him avoid pitfalls and gain confidence in his investment decisions. Aligning investment choices with areas of expertise reduces the risks of venturing into unfamiliar territory and miscalculating the value of a stock.

Examples of companies he acquired significant stakes in were Coca-Cola, Geico, and Sees Candy, as he understood the food and insurance industries very well. These companies also had a strong competitive advantage which helped for sustainable profits over the long term. Buffet describes a competitive advantage as a moat, as a business can profit from its dominance. His skill to find great companies with competitive advantages or ‘moats’ quickly became a major part of his investment strategy.

Key Idea 3 – Don’t follow the herd

The book explains a vital point about Buffett’s scepticism towards new paradigms. For example, during the dot-com bubble in 1999, many believed in a new era of consistently high returns in tech.

Buffet, however was cautious and explained that the inflated valuations could only be logical in specific market environments that he thought didn’t exist at the time. Soon after, the dot-com bubble burst and many following the herd in fear of missing out would take on large losses. Buffet strongly believes in having patience, discipline, and focusing on fundamental characteristics behind a business rather than short-term stock price movements.

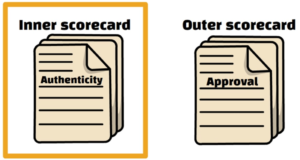

Buffet claims it’s useful to follow an inner scorecard instead of an outer scorecard, particularly during high valuations. What he means by this is that some people look for authenticity with the inner scorecard, versus approval with the outer scorecard.

Many people align with the outer scorecard as they seek validation from others as they feel judged by society. However, Buffett says its beneficial to be influenced more by our inner scorecard as no one can define your success but you.

For example, in the book, Buffett says, “would you rather be the world’s greatest lover while everyone thinks you’re the world’s worst, or the world’s worst lover while everyone thinks you’re the best?” If you chose the second option, then you’re guided more by your outer scorecard than your inner scorecard. Being influenced by your inner scorecard helps you avoid participating in the crazy valuations stocks can occasionally display. If he followed the herd out of fear of missing out on trends, he would not have avoided many stock market bubbles and would likely have had average returns.

The Snowball by Alice Schroeder draws on extensive interviews to deeply understand the man behind the incredible fortune. Despite his famous wealth, Warren Buffet has maintained a down-to-earth lifestyle living in the same modest home since 1958 and regularly eating at McDonald’s.

If you enjoyed reading this make sure you check out more content from the blog.