We’ll explore the 3 most common mistakes people make when investing in Vanguard LifeStrategy funds.

Mistake 1 – Tax Inefficiency

The first mistake is not understanding and optimizing tax benefits from the funds. LifeStrategy funds can have significant taxable bond allocations; therefore they make more sense for investors to hold their portfolio in a mix of taxable and tax-advantaged accounts.

Investors should consider the benefits lost on equities held in a tax-advantaged account. However, by holding bonds in a taxable account, the annual income tax on bond dividends can usually be avoided.

Additionally, an individual can often have the option to tax loss harvest certain asset classes in a taxable account. Tax loss harvesting involves selling assets at a loss to reduce the amount of capital gains tax. Most often investors use the technique with short-term capital gains as they are usually taxed at a greater rate than longer-term capital gains.

Another factor to bear in mind is when mixing funds, we can experience more significant growth in certain assets, which may imbalance our originally desired asset allocation. As a result, we may target other funds, which could result in closing positions in the portfolio meaning more capital gains tax being paid.

Mistake 2 – Mixing Funds

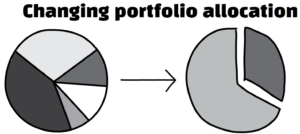

The second major mistake is mixing funds and not understanding the overall portfolio allocations as they fluctuate over time. To help solve this problem, the Vanguard LifeStrategy funds offer automatic rebalancing to make managing your investments as passive as possible. However, despite this, we can mix other assets into our portfolio, which changes the overall balance of it.

For example, you invest in the LifeStrategy 80:20 fund, which offers 80% equities and 20% bonds. Additionally, you invest in the 20:80 portfolio of 20% bonds to 80% equities, which gives an overall exposure of 50:50, which may seem pretty good. But let’s say you invest in the S&P 500 index plus the 60% equity to 40% bonds Vanguard LifeStrategy fund for equal amounts.

The problem begins when these funds grow because they will grow at different rates. This portfolio would end up with 80% equities to 20% bonds overall, but if equities outperform bonds, you could quickly end up with a 90% equity to 10% bond portfolio overall.

To help solve this problem, you could rebalance the portfolio and try to keep the portfolio as simple as possible to reduce the number of decisions you must make. The more investments we have, the more complicated we make our portfolio and the harder it is to maintain the right asset allocation.

Mistake 3 – Timing the market

The third big mistake many people make is trying to time the right time to buy and sell. Investors will often look to exit their LifeStrategy fund investment within the recommended minimum holding time as they try to predict market trends.

Not trying to time the market doesn’t necessarily mean investing a considerable lump sum at any point is a good idea.

For example, if you have a large lump sum and invested it all at once, it could lead to a lot of stress and anxiety if the markets crashed soon after. In this case, it could be wiser to divide the lump sum into smaller sums to invest monthly over six months, for example.

The most stressful period is often the initial few months of an investment, so spreading out a large lump sum will likely reduce the emotional impact. If you’re well diversified across many markets, which is what the LifeStrategy funds can offer, you’ll see results if you hold your investments for the long term.

More important than analyzing the market situation is to be aware of your overall financial situation before investing in one of these funds. Ideally, you want to have paid off high-interest debt, have an emergency fund, and be able to hold your investment for at least five years.

The ideal timeframe to hold the LifeStrategy Fund is for as long as possible, therefore you want to make sure you’re investing money you don’t need to spend.

Sensible times to consider selling part of your investment might be for retirement, when you may need more money. Also, if you’re considering adjusting the risk of your portfolio, you may look to sell part of your portfolio to replace it with another fund. For example, many will look to reduce their portfolio risk for retirement.

Vanguard introduced LifeStrategy funds to offer a different type of fund that could provide highly diversified funds with various portfolio allocations. The great thing about each LifeStrategy fund is that it is simple and easy to understand.

Each fund offers low fees and various fixed equities allocations to bonds depending on an investor’s preference.

Because the LifeStrategy funds offer bonds as part of the portfolio allocation, the drawdown of the portfolios with bonds plus stocks is likely to be less than a 100% stock-based portfolio. Although the returns of bonds are historically less on average than equities, the risk-adjusted return of a bond plus stock portfolio is greater.

It’s important to note that there are also some potential cons to be aware of when deciding to invest in one of the funds.

Firstly, the LifeStrategy Funds don’t include commodities that many investors may desire as part of a balanced portfolio. Also, the funds don’t offer much diversification with small-cap stocks or real estate investment trusts. Despite some of the cons, the Vanguard LifeStrategy Funds are worth considering.

If you enjoyed reading this make sure you check out more content from the blog.