We’ll review the top 3 most important things from Howard Mark’s book, The Most Important Thing – see what I did there.

If you’re unfamiliar with Howard Marks, let me inform you that he’s up there with investment heavyweights like Warren Buffett and Peter Lynch. Indeed, Buffett encouraged Marks to write this book – talk about a stamp of approval!

We’ll also cover interesting topics from the book such as:

- Why the majority of popularly held market beliefs are usually incorrect.

- Why market projections are often unhelpful, even when they are right.

- And why psychology is so important in market cycles.

Takeaway 1: Risk

Investing successfully boils down to understanding the connection between value and price. To help us decide what’s low and what’s a high price we can calculate the intrinsic value of a stock to help us. Accurately estimating intrinsic value is the crucial starting point for successful investing.

Just as you would inquire about the price of a car before purchasing it, evaluating the price in relation to an asset’s value is vital.

Prospective buyers should also consider psychological factors to ensure the price aligns with the asset’s value.

Psychological factors, such as fear and greed, significantly impact prices. For instance, collective fear may cause asset prices to plummet below their intrinsic value during economic instability due to a lack of buyers.

Howard dedicates three chapters to risk, breaking it down into understanding, recognizing, and controlling risk. Let’s start with the first one—understanding risk. You see, there are tons of misconceptions about risk. For instance, riskier assets don’t always guarantee higher returns. Otherwise, they wouldn’t be riskier, right? Not necessarily.

It’s all about figuring out an asset’s worth and comparing it to the price you pay— something called a margin of safety.

Now, let’s move on to recognizing risk. To achieve above-average results, you’ve got to identify the risk a particular asset carries and determine if it’s reasonable compared to what the market is expressing through its price.

Skillful risk control is the mark of a superior investor. As Warren Buffett says, “Rule number one: never lose money. Rule number two: don’t forget rule number one.” Simple, right?

Well, maybe not. The benefits of risk control don’t come in the form of measurable gains but rather in losses that don’t materialize.

Takeaway 2: Understanding market cycles

In the realm of investments, while nothing is certain, there are two steadfast rules we can rely on.

Rule number one: Most things follow a cyclical pattern driven by human nature. When investors succumb to their emotions, it generates cyclical trends in the market.

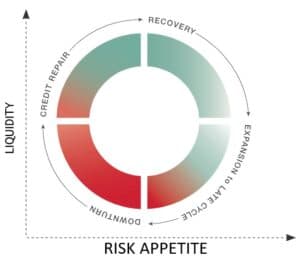

For example, consider the credit cycle, which involves the ebb and flow of credit availability over time. During periods of prosperity, when bad news is rare, risk awareness diminishes entirely. Consequently, banks offer credit with minimal restrictions and in extreme cases, even extend financing to unworthy borrowers.

However, when losses occur, banks become cautious. Risk awareness intensifies, leading to tighter credit restrictions. Some companies face bankruptcy due to a lack of capital and limited access to credit.

Then, the cycle begins to reverse. With fewer competitors providing credit to customers, banks can demand higher returns and improved creditworthiness. These enhanced standards pave the way for prosperity, perpetuating the cycle endlessly. This example illustrates why cycles are inherent in processes involving human behavior.

This brings us to rule number two: The most significant opportunities for gains or losses arise when others disregard rule number one.

Disregarding the cyclical nature of markets and extrapolating trends can be perilous for investors. This kind of thinking often leads to market bubbles, where buyers pay little attention to overpriced stocks because they are confident someone else will purchase them later.

However, the cycle inevitably reverses, resulting in market crashes. During downturns, buyers may be compelled to sell at any price to avoid financial ruin. This presents a golden opportunity for investors: There is no better time to invest than during a crash when you can purchase assets from individuals who must sell, regardless of the price.

The market swings between euphoria and depression, greed and fear, overpriced and underpriced. Various factors like economic conditions, investor sentiment, and market dynamics drive cycles. They can lead to excessive optimism or pessimism, creating opportunities for astute investors.

Howard advises us to consider these cycles and adjust our investment approach accordingly. When the market is exuberant and everything appears to be going well, it is critical to exercise care and avoid becoming swept up in the excitement. Conversely, during periods of extreme pessimism and fear, there may be attractive opportunities to acquire undervalued assets.

Takeaway 3: Contrarianism

The majority of investors follow trends, but successful investors do the opposite. Contrarian investors seek opportunities where the consensus view differs from their analysis. Going against the crowd is the key to profitable investments as crowds consistently make errors, causing market turbulence and swinging from overpricing to underpricing. The most lucrative investment decisions are contrarian: buying when others sell and vice versa. The holy grail is finding bargains based on market irrationality or limited understanding. Look for controversial, unpopular, or unknown assets perceived as worse than they actually are. Assets with low ownership have the potential for increased demand.

Despite initial discomfort, the best opportunities lie where others hesitate to go. It requires the courage to go against the prevailing sentiment and patience to wait for the market to correct its misjudgement.

Contrarian investing is not without risks, and thorough analysis is essential to ensure the underlying fundamentals support the contrarian thesis.

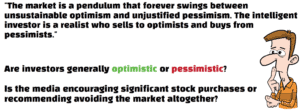

One must cultivate a disciplined mindset and try to detach from the herd mentality. Recognizing and managing one’s biases is crucial to rational investment decisions. Marks says, “The market is a pendulum that forever swings between unsustainable optimism and unjustified pessimism. The intelligent investor is a realist who sells to optimists and buys from pessimists.”

To summarize, here’s some practical advice from the book: Before making any investment decision, assess the market’s current state. When reviewing your portfolio, take a moment

to reflect on key questions that provide insights into the market’s current condition. Consider questions such as: Are investors generally optimistic or pessimistic? Is the media encouraging significant stock purchases or recommending avoiding the market altogether? Addressing these inquiries will provide valuable indications about the potential future trajectory of the market. If you enjoyed reading this make sure you check out more content from the blog.