Risk management is essential to help protect traders from substantial losses.

Even though risk management is essential, many traders still need to pay more attention to this area. Beginner traders often look to place their first trade and risk the maximum amount they’re willing to lose without a logical plan.

Criteria 1

The first criteria is to have a risk management plan. Sun Tzu’s famous quote from the book The Art of War was that ‘every battle is won before it is fought’, meaning planning can make a massive difference between success and failure. Many traders say plan to trade or plan to fail.

Before entering a trade, planning your stop-loss and taking profit orders is a good idea. This can change during the trade, but ideally, you should know where to move these orders based on predetermined market scenarios. Moving a stop-loss during a trade to take a greater loss is not recommended.

Successful traders can measure the resulting returns against the probability of a trade hitting a target – primarily because they think in terms of probabilities instead of certainties. Unsuccessful traders often think their trade will definitely win and therefore disregard the importance of calculating the risk for taking that trade.

Every strategy will have a drawdown period over a series of trades. If you have yet to determine what kind of drawdowns to expect, you’ll likely quit trading the strategy around the peak of the drawdown period. Traders who do this are like gamblers on a lucky or unlucky streak who let emotions dictate their trading decisions.

By having a risk management plan, we can avoid this and survive drawdown periods easier.

Criteria 2

The next criteria is calculating your expected return per trade or average trade expectancy, as some traders call it. Having an idea of this figure helps traders stay on the right track; if they aren’t, they can lower their risk per trade.

The formula is to take the percentage probability of a win multiplied by the average win size and add this to the likelihood of a loss multiplied by the average loss size. To work out this amount, you’ll need to be using a stop-loss and take-profit target so you know how much your risk is for each trade.

Here’s an example of using this formula. Let’s say you have a strategy that only wins 30% of the time, and your average win is $1000, so we do 30% times $1000.

The average loss is 200 dollars, and the loss percentage is 70%, so we do $200 times 70%.

This gives $300 for the win because $1000 times 30% equals $300, and 70% times $200 is $140 for the loss.

$300 minus $140 is $160, so the average trade expectancy for this strategy is $160.

A significant reason why this is important is that it helps traders or investors determine the opportunity cost of their risk. The 2% risk for one stock might not make sense if you don’t have the margin requirement to place another 2% trade for a different stock with a better expectancy.

Beginner traders will not have a realistic calculation for the probability of a win or loss because it often requires a large sample size of trades to help be more accurate in calculating this. This does not mean beginners should disregard this statistic; it just might not be so significant in your early days as a trader.

Criteria 3

The third factor is to consider a simple fixed percentage risk per trade which many traders follow. For example, you’ll put 1% of your capital into every trade. This is no golden rule; it can be too much or too little risk depending on your strategy and your goals. For example, putting on five trades per day you’ll likely want to risk less than if you’re trading only twice per month.

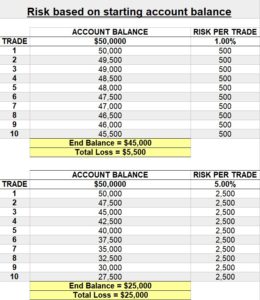

The diagram below shows examples of using 1% risk per trade on the starting balance over 10 trades versus 5% risk per trade on the starting balance.

As you can see, both examples are for the same account size of $50,000, and both are over 10 trades. Using 1% risk per trade, the net loss after 10 losses in a row is far less than the net loss using 5% risk per trade.

If your drawdown is 50% down, as shown by using 5% risk per trade, you’ll have to make 100% to get back to $50,000 again. This is why it’s essential to realize that compounding can work negatively and positively for your account. Beginners should start at less than 1% risk per trade and work their way up slowly to 1% – as long as their results are consistent enough for this to make sense.

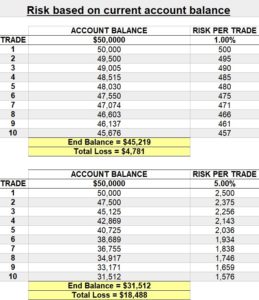

This diagram uses the same $50,000 account over 10 trades with 1% vs 5% risk per trade, but this time the risk is based on the current account balance instead of the starting balance.

The losses compared to the starting balance percentage risk per trade example are $719 less ($5,500 minus $4781) for the 1% example and $6,512 less ($25,000 minus $18,488) for the 5% example. This approach is recommended because its performance related as the risk per trade will increase or decrease depending on prior results. For beginners, using your current balance risk is recommended instead of the starting balance risk.

Experienced traders may consider starting balance risk based on their account balance at the beginning of each year or quarter, but this has no technical advantage.

If your current balance increases significantly, you may feel less psychological pressure sticking to last year’s starting balance instead of using the current balance amount. This is a sensible approach to using starting balance risk if you know that applying the current balance risk would have adverse psychological implications. However, this is not an advantage because you can have the same effect by reducing your risk per trade with your current account balance.

Criteria 4

Double-checking market orders and position-sizing calculations is critical to avoid making a costly mistake. Since electronic trading has made it easier for retail traders to start, it also means more traders need to learn more.

Remember to consider the importance of double-checking every input figure when using an online position-sizing calculator. You may think this is straightforward, but let’s see an example of how this mistake can easily be made.

Meet Newbie Nick. Nick lived in England his whole life and recently moved to Japan. While in Japan, one day, he got so caught up in making sushi that he forgot to check the markets. As he was a little late, he saw price moving away from his entry level. Nick rushes to open his position-sizing calculator and forgets to change his position-sizing account currency to the correct one.

As he had recently just moved country, it made it easier for him to make this mistake. By rushing and having other things on your mind, like sushi recipes, it’s far more likely to make an error. It may seem silly, but you’d be surprised how easy it can be done.

Always double-check position-sizing, and all other market orders, even if you’re not rushing.

Criteria 5

If you’re in a bad place with trading and feel like the market is out to get you – take a break. This does not necessarily mean you’re a terrible trader; it just means you may need a break to return feeling refreshed.

The good thing about trading is that you can stop by not opening your trading platform and then go back to it whenever. Taking a step back may help you view things from a different perspective, giving you time to take away your revenge mentality towards the markets.

After a bad month, you’ll likely risk more to make up for it. This effect can last many months or even years; taking a break is essential to reduce revenge emotions and refresh your mind.

During a break, you may also pick up on common patterns linked with negative results, which you could use to eliminate from your trading plan. Also, you may put time into other sources of income which could help ease the psychological pressure on trading.

Summary

The tips do not only apply to forex and stock traders. The tips will give you a better understanding of risk when trading or investing. Always know when to enter and exit before placing a trade.

Many beginners focus on the entry strategy and disregard the exit strategy. By being aware of how you’ll exit the trade, you can efficiently execute it without added risk.

Here are key takeaways from the risk management tips:

- Have a risk management plan. Every strategy has drawdowns. If you have yet to determine what kind of drawdowns to expect from a strategy, you’ll likely quit around the peak of the drawdown period.

- Calculate your expected return per trade. This figure helps you know if you’re on the right track and, if not – lower the risk per trade. Additionally, it helps to determine the opportunity cost.

- Using a fixed percentage risk per trade based on your current account balance is performance related, as the risk per trade will increase or decrease depending on prior results. Be aware compounding can work positively and negatively for your account.

- Double-check all market orders and each position size calculator entry.

- Take a break if you’re making consistent mistakes – it helps avoid revenge trading and refreshes your perspective.

If you found value in reading this check out the other posts in the Risk Management section of the website.