Market Analysis 15.10.25

Fed Chair Powell Raises Caution Towards Employment

Federal Reserve Chairman Jerome Powell raised caution on Tuesday as he mentioned risks towards employment. Regarding employment, he mentioned “available evidence suggests that both layoffs and hiring remain low, and that both households’ perceptions of job availability and firms.”

Additionally, he went on to say that inflation has not changed much since the Fed’s policy meeting last month. Powell stressed that it would be easier to assess the situation after the Fed receives official data again.

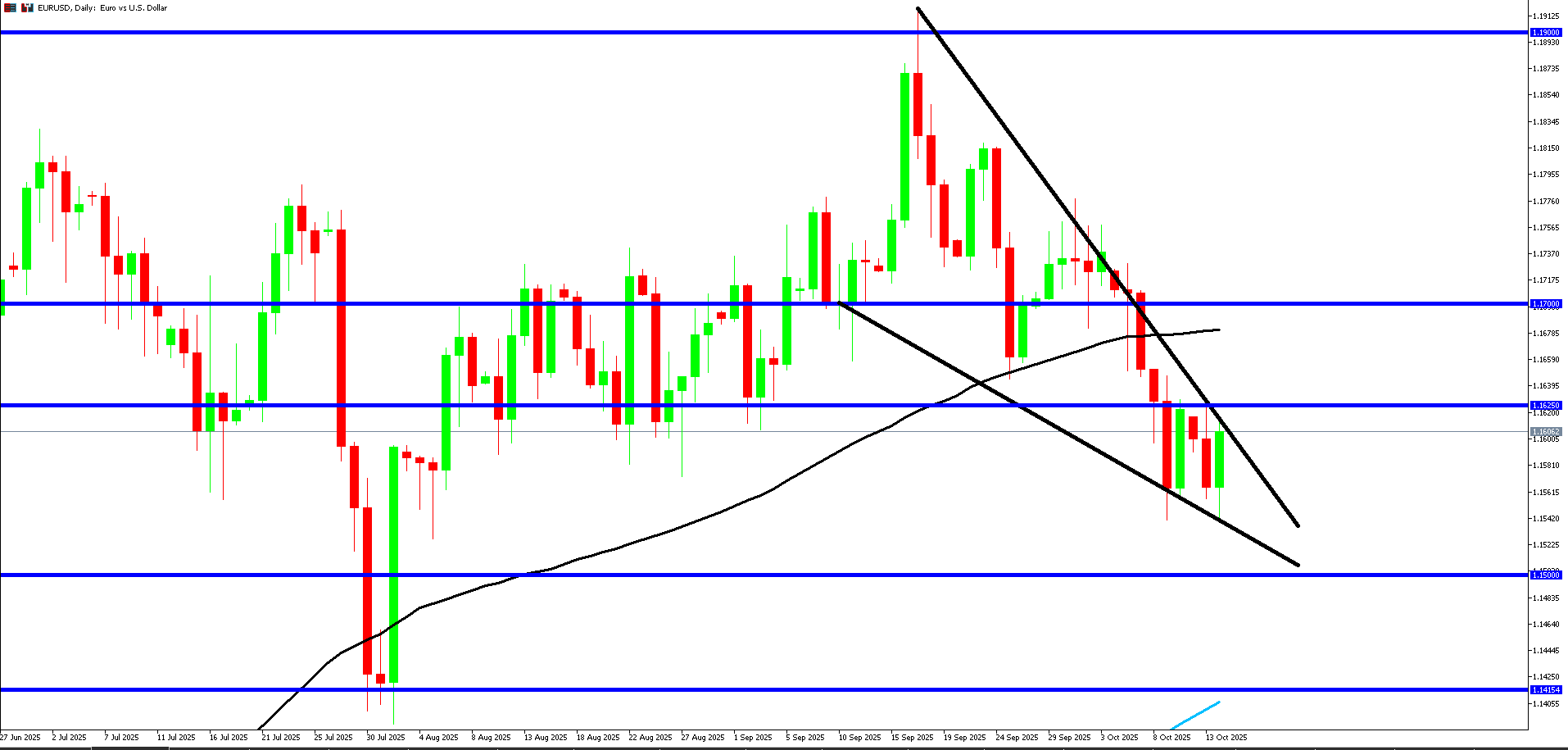

Following the news, EURUSD found support from the lower descending trendline to test the upper descending trendline for resistance. The price looks likely to find resistance from the 1.1625 pivot and fall towards the 1.15 pivot soon.

EURUSD Daily

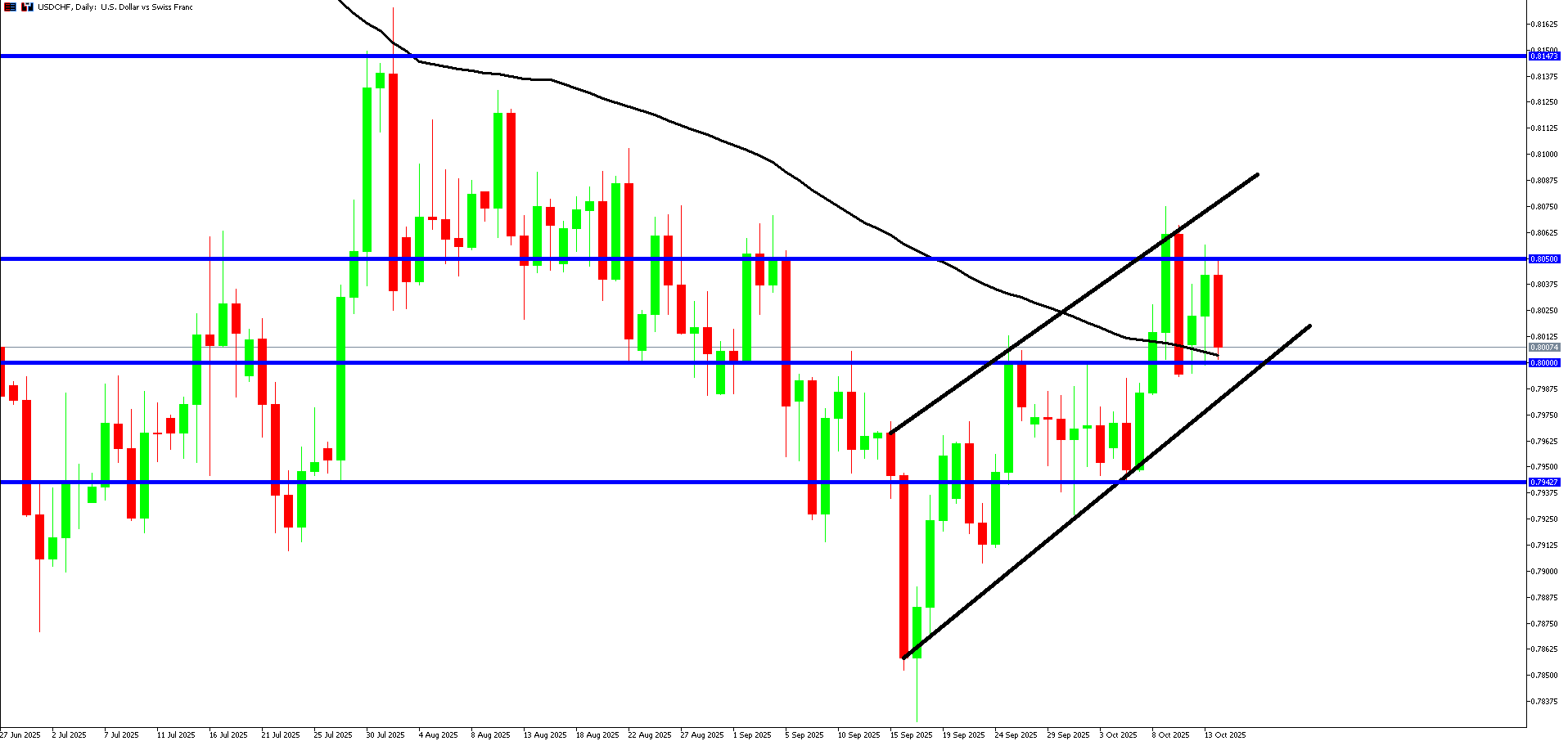

USDCHF has experienced sharp bearish momentum, with the price dropping from 0.8050 to test the 150 SMA (black line) for potential support. The price remains in a rising flag and looks likely to find support from the 0.8 pivot soon.

USDCHF Daily

BOE Governor’s Speech Softens Concerns

Bank of England Governor Andrew Bailey mentioned on Tuesday that the latest UK labour market report supports his opinion that inflation pressure is cooling.

While speaking at the Institute of International Finance in Washington, Bailey highlighted recent employment data for his assessment. Regarding the UK labour markets, Bailey said, “I’ve been saying this for some time, but I think we’re seeing some softening of labour markets.”

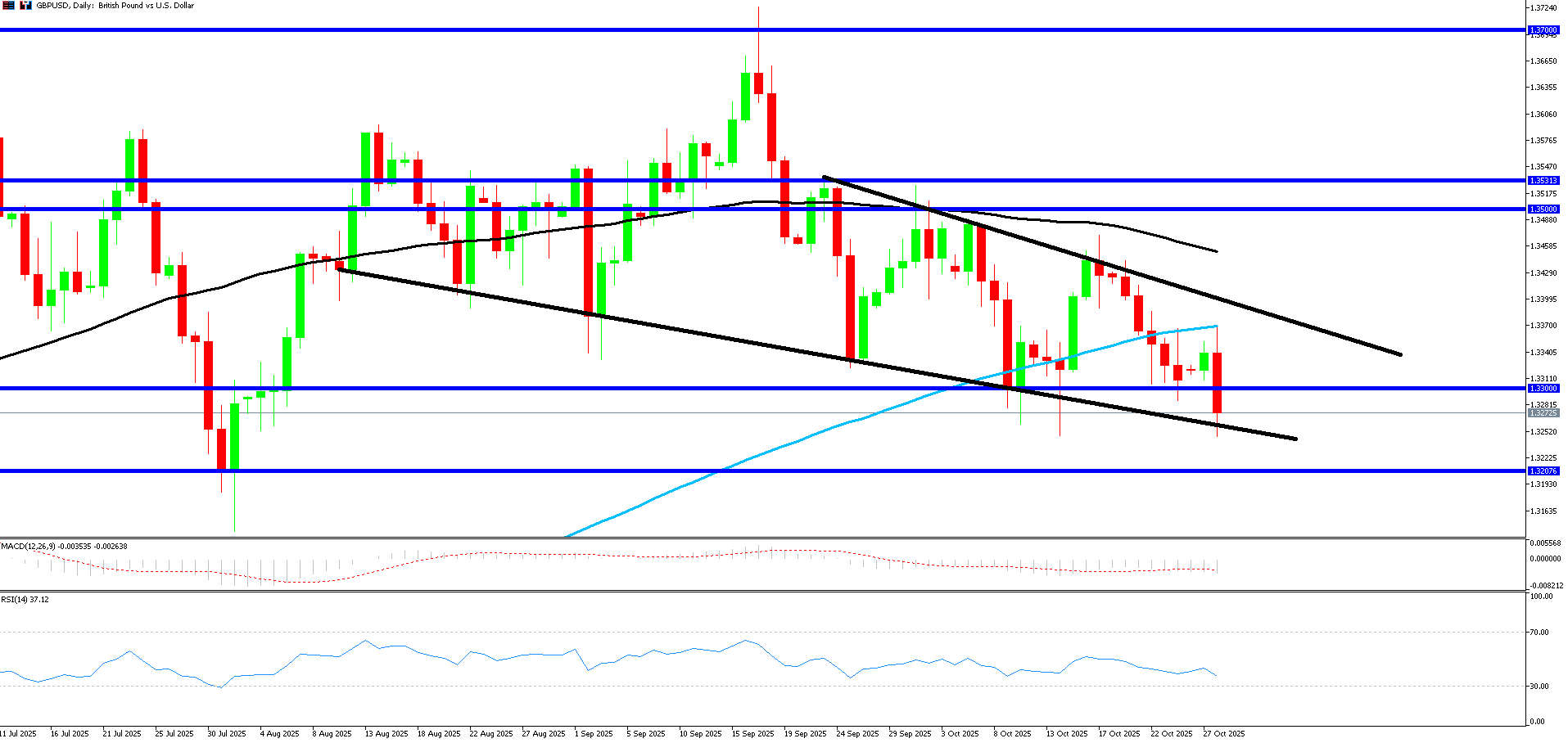

After the news, GBPUSD has rebounded rapidly from the 1.33 pivot and descending trendline. The price will probably rise to test the upper descending trendline and 1.35 pivot soon.

GBPUSD Daily

GBPUSD Daily