This guide will begin by explaining why a trading journal is critical to improving your results. Also, we’ll go through how to build a journal that covers significant trade statistics and update it in a highly time-efficient process.

But wait…Is that not what silly junior school students do? Yeah, of course!

OK, so not entirely…We are not talking about some silly diary here.

Professional traders and investors keep journals, not diaries. They are two very different things… let’s move on.

Here are essential non-trade performance reasons to keep a trading journal, so you know it’s not only about trade statistics:

- Identifying strengths and weaknesses in your ability to execute your plan and handle the psychological pressure.

- Tracking the progress of trading plan goals.

- Self-coaching – to improve your mentality towards trading.

Why journaling is crucial

So why is keeping a trading journal so important? Most professionals almost always keep a journal. For example, sports athletes keep journals to track their performance to improve strength, speed, or other attributes. Traders are often journaling to track performance to be more consistent and profitable.

Discipline is key to being consistently profitable, and a journal helps track your discipline with your plan. Sounds easy, but discipline is the hardest part.

Many traders do not bother with journals and rely on their spreadsheet records and broker’s log, but this doesn’t provide enough information. A trading journal is not just about recording entries and exits; it’s also about refining strategies and understanding your psychology towards those strategies. Spreadsheet records focus on stats like profit or loss, win rate, or average trade expectancy, but a journal focuses more on comments.

Journals are handy for tracking technical and mental information about your emotions before, during, and after a trade. For example, if you take a trade and feel it won’t profit because a previous similar setup lost money, you may close that trade early for break-even. However, that trade hits your target and now you’re frustrated, so you enter a weaker trade setup which ends up being a loss.

By tracking our mental state at the time, we can look back and better understand why we did what we did. If we note some of our mistakes and how we feel, it becomes easier to improve results.

4 major trading journal categories

OK, so now you know why journaling is important, let’s move on to what you should keep in your journal. I’ll go through four major things to put in your journal (they are not in order of importance).

1. Trade performance

Trade performance stats can include the trades that fit your trading plan; however, you’ll also learn a lot from other trades. Spreadsheets record profit and loss, win rate etc.; however, it won’t filter trades coming from mistakes or a missed opportunity for a trade. Additionally, you’ll want to include trades you passed on because you felt they needed to improve.

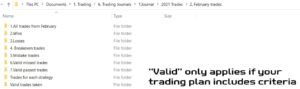

Look at the example journal to help get started; it shows how simple a journal can be. We’ll review each folder and the data within these folders. This journal includes information that works for our strategies; you should customise it for your trading style instead of copying it.

Within the February 2021 folder, we have a separate folder for everything, starting with all trades, wins, losses & break-evens.

Then we have mistake trades, missed trades, passed trades, trades for each strategy, and trades taken with a different trading plan we are testing. Within the mistake trades folder, I’ll include details such as entering at wrong levels, closing trades early and incorrect position sizing, which helps avoid repeating mistakes.

I recommend taking screenshots of your chart analysis if you use technical analysis – use free software like Tech Smith Capture to do this easily.

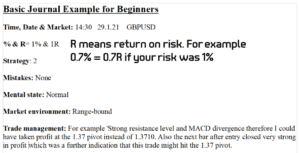

Look at this example of a basic journal document template below:

By the way, the letter R here stands for return on risk, so for instance, if it is 1% risk of my account per trade and 0.7 R, then it means I made 0.7% from that trade.

In the comments section, add other things you wanted to record that you couldn’t fit in the trade screenshot.

Look at the example I have written down. As you can see, if you’re a beginner you don’t need to cover so many details. Focus on the bigger picture to learn the most from your trades.

2. Market observations

Next, we have market observations. Here you should include trades from other strategies you’re tracking simultaneously to compare the performance.

Record market behaviour tendencies to help refine your trading plan accordingly. For example, a market may be very choppy or range-bound; therefore you might avoid that particular market until it breaks out of that market environment.

Also, include if your results suffer when trading through significant news releases such as central bank press conferences or non-farm payroll.

3. Mental state

Next, we can include your mental state. A typical example might be that you’re tired on a Friday and look to revenge trade after a bad week. Or you get Monday morning eagerness after your expensive weekend holiday, where you decided to eat lobster for breakfast, lunch, and dinner for some weird reason. You get my point; it may help indicate a pattern that correlates with your trading results.

4. Trade management

In this section, you can write for example, if you moved your stop-loss to break-even after a particular level hit that did not align with your plan. Another example might be taking profit early because you’re worried about price hitting a strong support or resistance level, but this is not part of your plan.

Summary

Keeping your journal updated will help you treat trading similarly to if you were to start any other type of business. The journal is for your benefit so prioritise the information you think will help you the most. You can use my way if you’re starting; however, you’ll want to customise it later because each trader is unique.

You don’t need to spend time developing Excel formulas to have an effective and easy-to-interpret journal. Refrain from wasting time building it to cover every small aspect, as this will distract focus from the more important facts. Including every bit of information will make you less motivated to update the journal, and you’ll then lose all the benefits.

Focus instead on improving the main things, as they will make the most significant difference.

If you’re interested in learning more about trading and investing make sure you check out similar topics in the risk management section.