A mortgage is likely to be the most significant expense for most people; therefore it’s crucial to be aware of the 4 biggest mistakes. With mortgage interest rates increasing recently, getting the best rates possible and avoiding major mistakes is becoming more critical.

If you’re a first-time buyer or have never had a mortgage this will be extremely helpful.

Mistake 1 – Being unaware of exotic mortgage products and the pros and cons of interest-only mortgages.

Interest-only mortgages offer pros such as lower monthly payments, allowing people to invest a larger amount each month into other assets. Investing into other assets can provide greater diversification to your portfolio. Additionally, by investing in stocks, for example, you can have greater liquidity as it’s quicker to sell stocks than a property.

The big mistake many people make is not being disciplined to invest the additional money they have each month and instead spend it. However, a repayment mortgage is a fantastic way to force yourself to save money each month instead of potentially wasting it.

The second major disadvantage is that you’re at risk of increasing interest rates, which could leave you struggling to pay the mortgage. This is why it often makes more sense to lock in a fixed interest rate for a more extended period when on an interest-only mortgage.

You’ll also need to analyze the short-term versus long-term pros and cons of interest-only mortgages, as many people miscalculate this. You may often feel better off in the short term with interest only; however, if you fail to invest much of the money you save on your monthly repayments, you’ll likely be in a terrible situation later on.

The last thing you want to do is take a mortgage based only on your emotional connection to the home while not looking at logical factors. Factors such as your budget, long-term versus short-term pros and cons, and your behaviour with managing money are all important to consider.

Many exotic mortgage products result in buyers having negative equity as they don’t understand what they are getting themselves into. The products are commonly referred to as negative amortization products, as borrowers often increase the amount they owe each month until their debt builds so high that it leads to foreclosure.

Mistake 2 – Not getting an early offer to get the best rates

By waiting till the last minute, you could pay thousands extra every year. We can see the rates for the previous year for 30-year mortgages in the U.S. It’s interesting to see how the rate has changed by more than 1% over the last year. A higher LTV, meaning loan to value, means the higher the rate you’ll likely get. If you got a mortgage in February, you would have saved a huge amount compared to getting one in September.

To help you get the best rate possible, you can start looking for rates around 6 months before your current mortgage’s fixed rate expiry date. Your current mortgage lender usually won’t tell you until around 3 months before your current mortgage fixed rate is set to finish, but if you look for a new lender you can secure an offer 6 months before.

By locking in an offer with a new lender 6 months before, you can be patient to see if you’ll get a better offer until the expiry date of your current mortgage. Don’t assume that central bank rates will always correlate closely with mortgage rates as historically this hasn’t always been the case.

Make sure you look for a good mortgage broker to assist you in finding the best possible deal that meets your needs.

Additionally, it would help if you talked to multiple lenders to compare the rates, lender fees, and loan terms on offer. As rates can change quickly, you should consider getting multiple rates to compare on the same day.

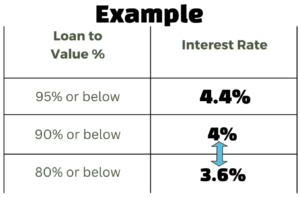

Mistake 3 – Being unaware of rate brackets

Depending on the rate differences for the Loan to Value, you could save a lot of money by going to the next loan-to-value rate bracket. Mortgage rates typically take the next step up every 5% increase for the loan to value.

Let’s look at an example to see how much someone could potentially save. If your loan to value is at 86% and you can get a lower rate at 85% LTV, you could be better off paying more upfront to save more in the long run.

Getting a mortgage can be a long and complex process; therefore, planning well in advance for a deposit and closing costs is key. Rushing the process can prevent you from improving your credit report to get better terms for your mortgage. It can take months or even years to improve a credit score and save more to be in a better situation to get pre-approved.

Also, evaluate how much a mortgage would impact your total budget, as many people become emotionally connected to a home that is beyond their means. Struggling to make house payments might cause health problems and limit spending in other areas such as a retirement account, student fees, and holidays.

Furthermore, if you move into a larger house, you’ll have to factor in more costly renovations, repairs, property taxes, home insurance, energy bills, and upkeep charges. It may shock many people how much extra electricity, gas, property taxes, repairs, and renovation costs can add up for a larger-sized property.

The solution is to look at what you can comfortably afford instead of the biggest amount you qualify for. During the Great Recession in 2008, the U.S. economy was impacted by borrowers having difficulty paying their mortgages.

There were numerous reasons for this trouble with repayments, including so-called “liar loans”. Liar loans were very popular before the 2008 recession, as borrowers could provide their lenders with details without providing appropriate documentation.

Please bear in mind everyone has their unique circumstances, and you should seek professional advice to get the best deal possible. Getting a mortgage that’s right for you will depend on many factors that you and a professional advisor will be able to make.

If you enjoyed reading this make sure you check out more content from the blog.