Client: Vanilla Investor

Service: The client wanted his book summary edited. I improved the grammar, punctuation and spelling while simplifying the writing to make it more concise and easier to understand with relevant examples.

Here is part of the blog post:

Do you think individual retail investors cannot compete against Wall Street professionals?

Many believe so when considering the complexity of financial markets and high-frequency trading technology. However, “A Random Walk Down Wall Street” by Dr. Burton Malkiel challenges this.

We’ll explore Malkiel’s fascinating ideas by focusing on six key insights. With over 1.5 million copies sold, this classic book summary is definitely not one to miss.

Dr. Burton Malkiel is well-known as an economist with an MBA from Harvard University. His book was published in 1973 and since then it has impacted several industry professionals who have served on the Vanguard investment management company’s board of directors.

Shockingly, Malkiel claims that a blindfolded chimpanzee throwing darts at stocks can do equally as good as professional investors!

Key insight 1: Fundamental and technical analysis limitations

Many rely on the fundamental approach that an investment’s price should reflect its intrinsic value. Fundamental analysis often attempts to identify assets with intrinsic values higher than their current price. Malkiel, on the other hand, believes that inaccurate information, analysis errors, and unexpected events may lower the accuracy of fundamental analysis. With these limitations, it’s easy to see that fundamental analysis isn’t perfect.

Another strategy investors often use is technical analysis which focuses on the behavior of historical prices. Technicians believe the markets are mostly moved by others identifying patterns and trends. But Malkiel argues that technical analysis alone will probably fail to beat the market consistently.

While technical analysis can provide objectivity and consistency when following a plan, it also has disadvantages. Some cons include false signals and hindsight bias, often resulting from inaccurate historical price data and user bias when backtesting. Further disadvantages include sharp reversals due to significant news releases, which can cause slippage that’s difficult to account for accurately when backtesting strategies.

The book explains how in addition to fundamental and technical analysis, human psychology plays a major part in a market’s unpredictability.

Overconfidence, biased judgements, herd mentality, and loss aversion are all examples of common psychological behavior which can make it even challenging to outperform the market consistently.

Key insight 2: The random walk theory

The “random walk” concept in statistics refers to the unpredictable movement of variables that are devoid of any established relationship with historical data or other factors. Malkiel suggests that stock prices behave randomly over the short term without any apparent correlation to past values or other variables.

Despite this, the random walk theory doesn’t rule out the chance of patterns and relationships forming in stock price movements. The idea mainly applies to short-term timeframes.

The random walk theory shares similarities with the Efficient Market Hypothesis, which has three versions: weak, semi-strong, and strong.

The weak form suggests that the market reflects all the current price information, making technical analysis ineffective.

Next we have the semi-strong form which claims that the market reflects all publicly available data, meaning that technical and fundamental analysis is practically useless.

And lastly, the strong form implies that the market always mirrors the actual value of an assets, making even insider knowledge worthless. Although Malkiel acknowledges the limitations of beating the market consistently, he doesn’t fully support the strong version in the book.

So how can retail investors beat Wall Street given the disadvantages of popular investment analysis techniques and human psychology?

Malkiel’s answer is simple and effective: investing for the long run in low-cost index funds. Diversifying across the broader index funds can help investors with lower risk tolerance.

He focuses on making investment returns that beat inflation and places importance on methods that maintain purchasing power.

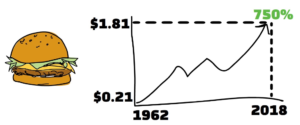

To help understand how important it is to beat inflation, let’s look at the rising cost of a McDonald’s burger from 1962 to 2018. The burger price went from $0.21 in 1960 to $1.81 in 2018, an incredible increase of over 750%. The example helps show the impact of inflation and the importance of beating it in order to build wealth.