We’re going to cover the five most valuable parts from the fascinating book Super Trader by Dr Van Tharp.

Dr. Van Tharp is a renowned trading coach and the founder of the Van Tharp Institute, a leading educational institution for traders and investors worldwide.

He has extensively studied over 5,000 successful traders to develop a blueprint for success from which new traders can learn. Whether you’re a novice or an experienced trader, Tharp equips you with the necessary tools to thrive in an industry where most individuals falter.

Have you ever wondered what separates successful traders? It’s not just luck or talent. The critical message that Dr Van Tharp preaches is that anyone can become a successful trader with the right tools and mindset.

So, what is the secret formula for successful trading, according to Dr. Tharp? He emphasizes a five-step process that addresses the core trading areas, including human psychology, money management, and system development.

1: Working on Yourself

Recognizing that our beliefs shape us, Tharp emphasizes the significance of self-reflection. We can break free from self-imposed limitations by examining our beliefs and assessing their usefulness. Tharp guides readers through a comprehensive self-assessment in this section, including a 17-point questionnaire that distinguishes true traders and investors from mere pretenders.

He stresses the importance of commitment, personal responsibility, empowerment, and overcoming obstacles. Moreover, Tharp helps traders address the beliefs that influence their trading decisions, fostering a mindset conducive to success.

As a neuro-linguistic programming modeller, he studies individuals who excel in their fields, identifies commonalities in their beliefs and mental strategies, and teaches these skills to others. By focusing on the personal aspect, Dr Tharp ensures that traders are equipped with the right mindset to succeed.

Trading, like any profession, requires domain knowledge and practice. Just as one cannot become a successful brain surgeon overnight, becoming a skilled trader takes time and effort. Many traders concentrate solely on system development, overlooking the impact of their psychological biases, which often leads to poor or mediocre returns.

It’s crucial to work on beliefs, mental states, and mental strategies before perfecting the nuts and bolts of a trading system.

Why is psychology so important in trading?

Well, humans are emotional beings, and these emotions often interfere with trading decisions. From the fear of losing money to the desire to outperform other traders, these emotions can have devastating effects on trading performance. Therefore, developing the right psychological mindset is paramount.

So, how do we get our trading psychology right? Dr. Tharp emphasizes the first step of working on ourselves to achieve psychological mastery. This involves knowing ourselves, identifying harmful beliefs, and addressing our fears and setbacks. By being proactive and developing a positive mindset, we can trade responsibly, persevere through challenges, and flawlessly follow our trading strategies.

Another aspect of psychology is maintaining the right attitude. Traders must take responsibility for their failures and successes, shed all excuses, and practice mindfulness.

2: Developing a Business Plan

Trading should be approached as a business endeavour, and a well-crafted plan is essential for success. Tharp instructs readers on developing a comprehensive trading business plan incorporating their beliefs, strategies, and systems. This document becomes an indispensable assistant throughout one’s trading journey, serving as a reference point for decision-making.

A trading business plan provides direction and encompasses all aspects of our trading, including contingency plans for different market conditions or unexpected events. We can navigate challenges and stay on track by planning for these eventualities.

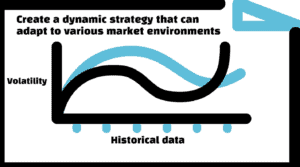

3: Developing Trading Strategies for Various Conditions

Market conditions are in constant flux, rendering many strategies obsolete. Tharp emphasizes the need to read the market and design strategies that adapt to the current environment. By understanding the six market types, readers gain insights into crafting strategies that work effectively in each scenario.

Each trader should have a strategy that aligns with their beliefs and psychology. A successful trading system incorporates excellent risk management, is adaptable to different market conditions, and is measurable regarding historical and current performance. Developing our trading system within this framework can build confidence, discipline, and consistency.

4: Understanding How to Meet Your Objectives

Contrary to popular belief, your trading system alone does not determine your success in meeting objectives. Tharp reveals the critical role of position sizing strategies in achieving goals. By grasping the basics of position sizing and implementing appropriate methods, traders can align their trading with their desired outcomes.

Finding the optimal position size based on risk management principles is crucial. Risking too little may not be worth the effort, while risking too much can lead to significant losses. Dr. Tharp introduces various position sizing models, such as the fixed fractional and the percent volatility methods, to help traders determine their position sizes based on risk tolerance and market conditions.

5: Minimizing Mistakes for Maximum Profits

Mistakes can be detrimental to trading success, but Tharp teaches readers how to navigate and learn from them. By establishing rules and avoiding repeated mistakes, traders can minimize their negative impact on profitability. Tharp urges traders to recognize and rectify their errors, ultimately cultivating a more profitable trading approach.

These rules guide us, ensuring we stick to our trading plan and avoid impulsive or emotional decisions. The rules cover entry and exit criteria, stop-loss orders, profit targets, and any other conditions that must be met before executing a trade.

In addition to these core steps, Dr. Tharp addresses other important factors in trading success. He highlights the significance of continuous learning and improvement, maintaining accurate records of trades, and reviewing and analyzing performance to identify areas for growth. Dr. Tharp also emphasizes the importance of building a network of experienced traders and mentors who can help provide guidance.

Overall, the book is a comprehensive guide combining psychological principles, money management strategies, system development techniques, and practical advice to help traders make consistent profits in favorable and challenging market conditions. Dr. Tharp provides a holistic approach that sets traders up for long-term success by focusing on personal development and addressing the psychological aspects of trading.

It’s important to note that while the Super Trader book offers valuable insights and principles, success in trading ultimately depends on an individual’s dedication, discipline, and ability to adapt to changing market conditions.

Super Trader by Dr Van Tharp is a valuable resource as it provides a structured framework and practical guidance to help you develop the mindset, skills, and strategies needed to thrive in the world of trading. Drawing upon his extensive experience, he presents a simple plan tailored to assist anyone in navigating the market successfully. Unlike his previous works, “Super Trader” showcases Tharp’s exceptional talent for conveying complex ideas in an accessible manner. If you liked reading this make sure you check out more content here.