Billionaire investors are often thought of with a mix of wonder and distrust.

Many have a kind of genius but are their abilities transferable?

And, aside from how to make money, do they have anything else to teach us?

In the top-rated book Richer, Wiser, Happier, William Green draws on twenty-five years of conversations with several of the world’s most successful investors to help answer these questions. As he realized, their abilities extend far beyond the area of finance.

In this post we’ll go through five fascinating key ideas from Richer, Wiser, Happier by William Green. He mentions that if you only focus on the financial gains, you’re missing the bigger picture because investors should not only become richer but also wiser and happier.

The book delves into the strategies of legendary investors such as Mohnish Pabrai, John Templeton, Howard Marks, Jean-Marie Eveillard, Joel Greenblatt, Nick Sleep, Tom Gayner, and Charlie Munger. William Green focuses on the key concepts that these investors applied in their lives to beat the market. Let’s look at five key concepts from some of the great investors mentioned in this book.

Key idea 1: Invert, Always Invert

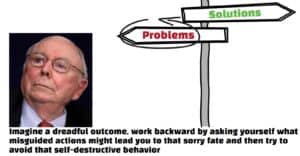

To help illustrate this point, highly respected investor, Charlie Munger once said, “All I want to know is where I’m going to die so I’ll never go there.

Inversion is the art of turning a problem on its head. Rather than asking how to be a wonderful partner, consider how to be an awful partner and avoid those

behaviours. Apply this concept to investing by focusing on avoiding bad investments rather than searching for the perfect one.

Following this point, Munger once said, “Imagine a dreadful outcome, work backward by asking yourself what misguided actions might lead you to that sorry fate, and then scrupulously avoid that self-destructive behavior.”

Think of the stock market as a block of marble that can be sculpted into beautiful artwork by chipping away bad investment ideas. Remove what is outside your circle of competence, discard businesses with incompetent or dishonest management, and invest in companies with long-term prospects at a reasonable price.

Key idea 2: Clone

Mohnish Pabrai emphasizes the power of cloning successful investors. We can enhance our investment approach by learning from the best and emulating their strategies. Mohnish launched the Pabrai Investment Funds (PIF) in 1999, inspired by the original Buffett Partnerships of the 1950s. The fund had an annualized gain of 11.4% as of March 2022.

Mohnish’s secret? He doesn’t come up with genius ideas himself; he simply copies smart ideas from others. Pabrai studied and emulated the legendary Warren Buffett, even going so far as to pay $650,000 to have lunch with him. So, let’s learn from the best in any field we wish to succeed in and strive to imitate their success.

As the saying goes, “A wise man ought always to follow the paths beaten by great men, and to imitate those who have been supreme, so that if his ability does not equal theirs, at least it will savor of it.”

Key idea 3: Strategy consistency

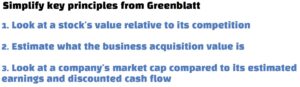

The third key point is that you don’t need the best strategy. You need a sound approach that will allow you to meet your financial objectives. Joel Greenblatt achieved remarkable profits as a managing partner at Gotham Capital, the hedge fund he started in New York City. Over two decades, the firm averaged an astounding 40 percent annualized return. He’s also the author of the trendy New York Times best-selling book ‘The Little Book that Beats the Market.’

Greenblatt once said, “The best investment strategy is not the highest returning one, but the highest returning one that you are able to stick with. We can often get caught up in the pursuit of perfection, which can hinder progress. Your plan should be so straightforward and rational that you understand it, believe in it completely, and persist with it even when it no longer appears to be working.”

As investors, we face the challenge of predicting an uncertain future. Rather than pretending to have all the answers, being honest about our limitations is essential. Understanding that nobody can consistently predict outcomes in every stock or industry allows us to focus on areas where we have an edge. Use history as a guide for the future, as patterns tend to repeat. Identify potential vulnerabilities and actively work to minimize them. Remember, it’s not about predicting the future perfectly but preparing for different outcomes.

Key idea 4: Focus on the ultra-long run

Nick Sleep and his partner Qais Zakaria managed the Nomad Investment Partnership for over a decade, delivering 921% returns vs. 117% for the MSCI World Index between September 2001 and December 2013.

Nick Sleep, an investor who achieved exceptional returns, believes in focusing on the ultra-long run. He disregards short-term price fluctuations and instead devotes time to understanding a company’s long-term prospects. By asking questions like where the company wants to be in 10 to 20 years and what management must do to reach that destination, Sleep sets himself up for success. While many on Wall Street obsess over quarterly earnings, shifting the focus to the long run can provide a significant edge. Trying to chase the perfect investment or timing the market perfectly often leads to poor decision-making and emotional stress.

Having a disciplined approach is a key aspect of Nick Sleep’s non-perfect perfect strategy, as he calls it. Create a systematic investment plan and stick to it, regardless of short-term market fluctuations. This helps you avoid emotional biases and impulsive actions driven by fear or greed. Develop a set of criteria for evaluating investments, such as financial metrics, competitive advantages, and management quality, and consistently apply them to make informed decisions.

Furthermore, a non-perfect perfect strategy involves ongoing learning and improvement. Continuously educate yourself about investing, stay updated on market trends, and learn from your successes and failures. Surround yourself with a network of knowledgeable investors, join investing communities, and seek out mentors who can provide guidance and support.

Remember that investing is a long-term endeavour. The power of compounding returns becomes more significant over time. Resist the temptation to make sudden changes based on short-term market volatility and remain patient for your long-term investing goals.

Key idea 5: Investing means more than making money

The fifth key insight from this book is that investing is about more than simply gaining money; it is also about personal development and overall well-being. The book discusses the importance of having a calm mind, cultivating personal habits, and developing mental resilience. The investors in this book highlight the value of developing a strong character, remaining disciplined, and taking care of one’s health.

Reading “Richer, Wiser, Happier” has been an enlightening experience for me, and it has provided valuable insights into my investing journey. I’ve learned to focus on embracing a long-term mindset, and continuously improving my investment approach.

While I’ve mentioned some of the key takeaways, the book covers many more investors and their approaches, allowing readers to explore what works best for them. Whether you resonate with concentrated portfolios, diversified holdings, or other strategies, the book provides valuable insights into various investment philosophies.

In summary, being a successful investor goes beyond merely making money. It involves emulating the strategies of great investors, embracing inversion to avoid mistakes, focusing on the long term, making decisions under uncertainty, and adopting a non-perfect perfect strategy. If you enjoyed reading this make sure you check out more content from the blog.