Market Analysis 29.10.25

US Consumer Confidence Declines as Job Concerns Rise

US Consumer Confidence was 94.6, beating forecasts of 93.4 but remained lower than 95.6 previously. The constant pessimism about job availability and rising income prospects are the primary drivers of lower consumer confidence. Also, future business conditions and inflation expectations are shifting slightly higher, adding to the declining confidence. As a result, it’s the third consecutive monthly decline.

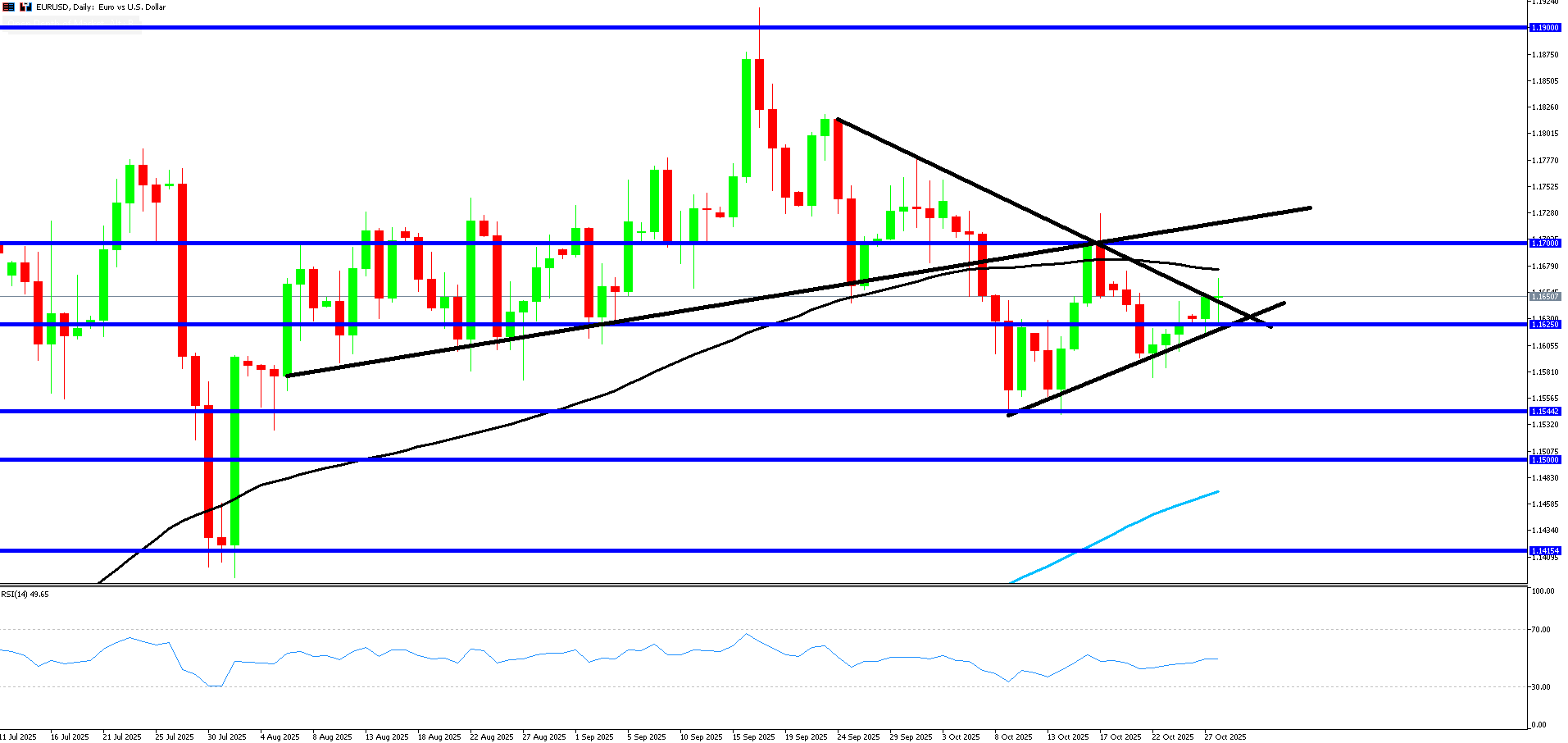

Following the news, EURUSD has broken out from the descending trendline after finding support from the ascending trendline and 1.1625 pivot. The price is currently at a neutral relative strength level and is near the 100 SMA (black line), which will likely provide short-term resistance. If the price pushes through the 100 SMA, it will likely find resistance from the 1.17 pivot, which coincides near the upper ascending trendline pullback.

EURUSD Daily

EURUSD Daily

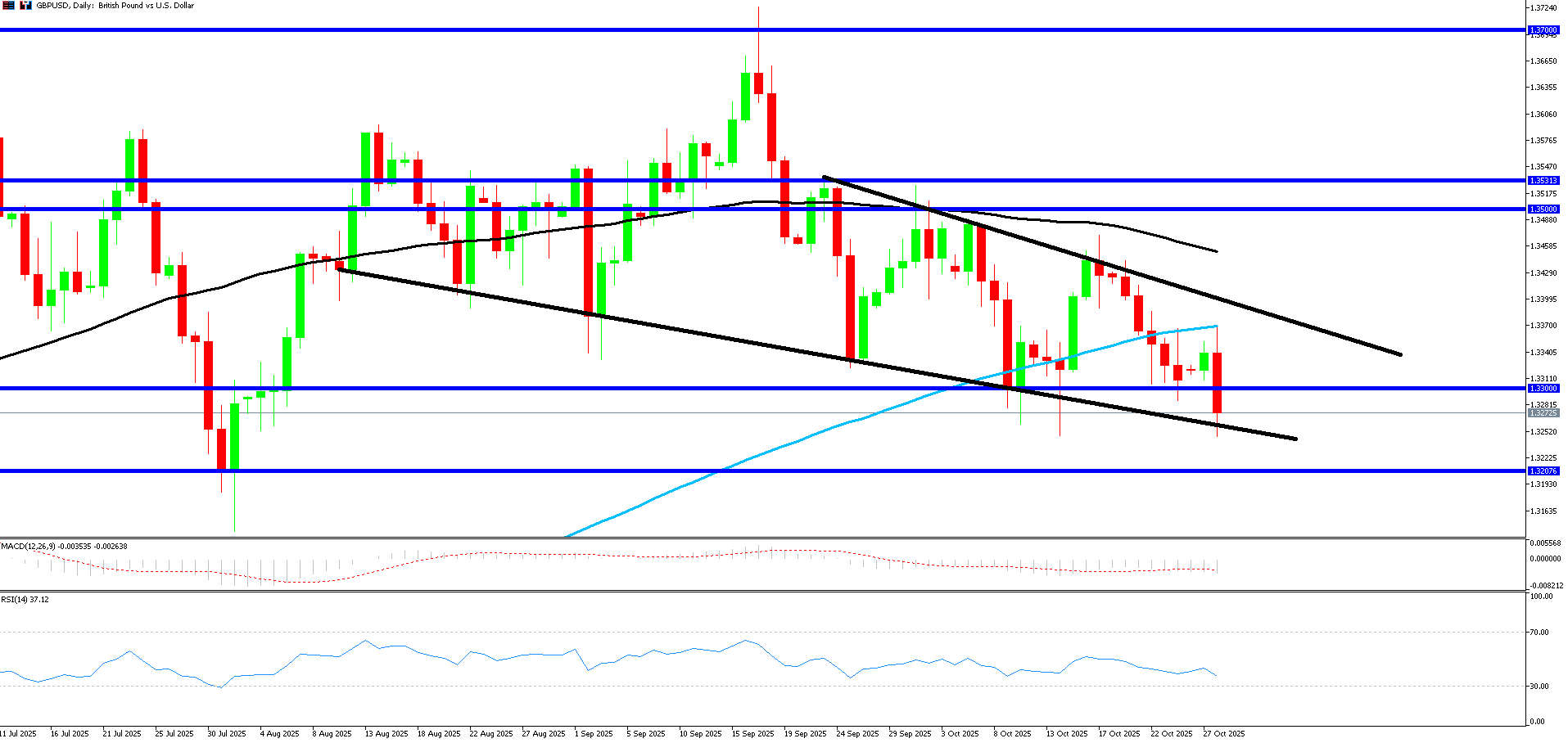

GBPUSD has found strong resistance precisely from the 200 SMA (blue line) and is currently held up by the lower descending trendline. Additionally, the price is finding support from the 1.3250 level which has seen multiple recent swing lows, and RSI is closer to being oversold as it approaches 30.

GBPUSD Daily

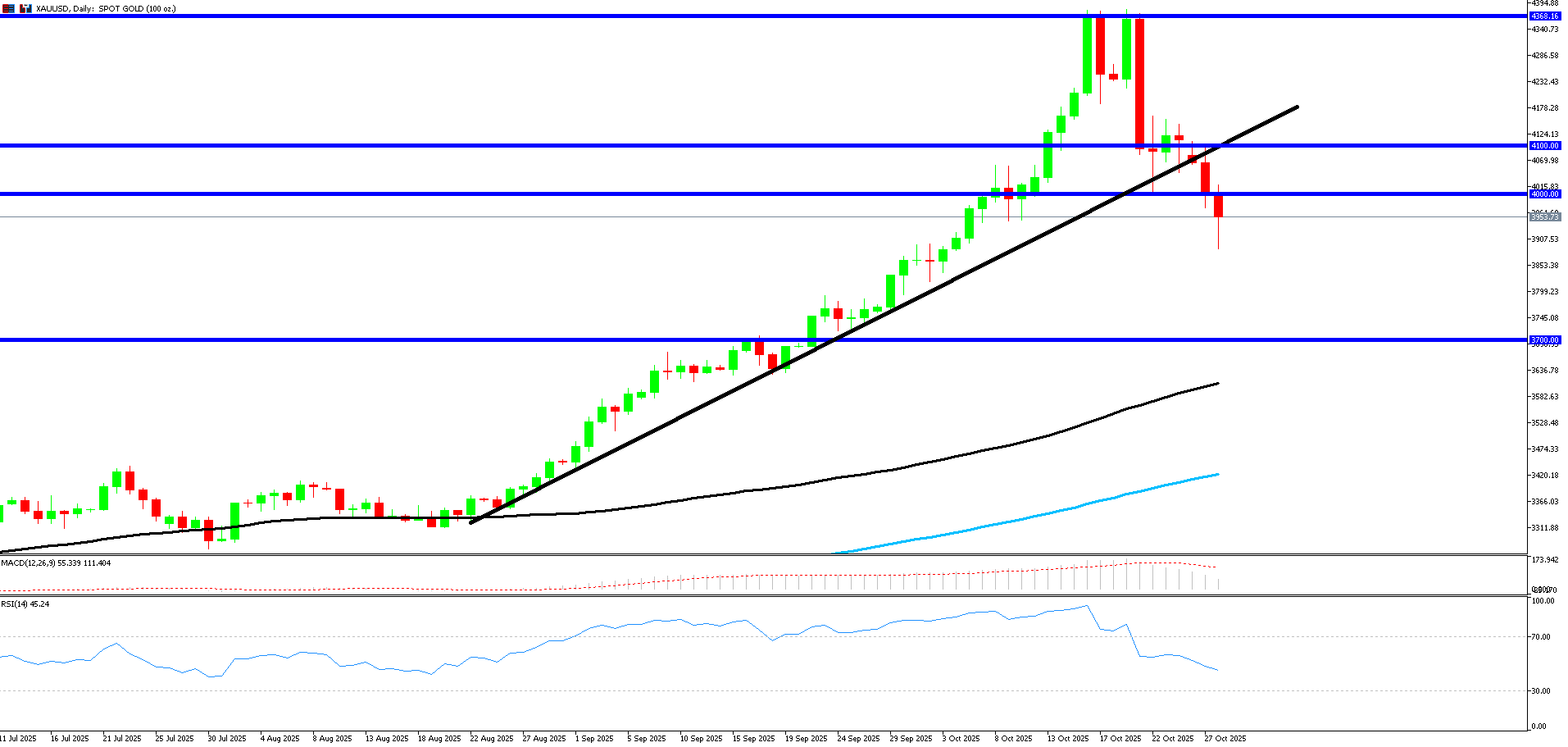

Gold Crashes Over 10% this Week

Gold has made a remarkable turn this week as it makes its sharpest drop in over a decade. The decline came after a surprise US-China trade deal that reduced the likelihood of 100% tariffs.

After the news, Gold broke out of the ascending trendline and found resistance at the 4000 level. The price is still a long way from the 100 SMA (black line) and the 200 SMA (blue line), while the RSI remains near a neutral level. The next price pivot is around 3700, where the price will probably find support.

XAUUSD Daily