It’s critical to have a good understanding of margin when trading, especially when trading forex. Without a good understanding of margin when trading forex you will not understand how to manage risk. Margin applies not only to forex trading; you can also use margin accounts for stocks, futures, and other ways of trading.

A significant appeal of forex trading is the ability to trade with margin. Despite this, margin trading is still commonly misunderstood or sometimes completely overlooked by many forex traders.

We’ll start by reviewing what margin is when trading forex with examples for each to help you understand it. We will go through used margin, free margin, margin level, margin call level and stop-out level. These will be explained in six parts with examples to help understand them.

What is Margin Trading?

The idea of using margin is to use your money to control a more significant position in a market that you otherwise could not. A margin trading account is simply a brokerage account that allows the trader to trade money borrowed from a broker. Your margin refers to a trader’s equity in their margin brokerage account.

Using margin to make a trade is like using the equity in your account as collateral for a loan. You’re borrowing money to place a larger position size for your trade or investment opportunity. The required margin is like a deposit which you will get back once you close out your trade positions. The cost of using margin is the interest cost which is usually a relatively small amount compared to the trade size.

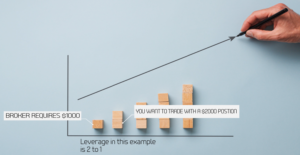

The amount of money you borrow compared to the amount of equity you have is the leverage you use. For example, if you want to trade using 2000 USD and your broker requires 1000 USD, your leverage is 2 to 1. Leverage refers to taking on debt, and margin refers to the actual debt or borrowed money. Basically, you are using margin to create leverage. To make it simple, margin is the money borrowed from a broker, and leverage is the measurement of the money borrowed compared to your equity.

The leverage measurement is shown as a ratio; for example, the current max leverage for forex majors is 1 to 30 from most regulated brokers. With your equity, you can get up to 30 times a greater position size in forex majors. When using leverage, it’s crucial to know that losses and gains will be magnified. Even though they are interconnected, leverage and margin are not the same. They are both commonly used terms in the financial world; therefore, it’s essential to understand this if you want to have a good understanding of margin trading.

Used Margin Explained

Now that you know what margin is, we will go through some common terms related to margin when trading. You must understand that used and free margin are important metrics in a margin trading account.

To understand used margin, we must first understand the required margin. Your broker specifies the required margin, or you can use the leverage amount specified by your broker to work this out. For example, if you are trading forex majors, your max leverage is likely 1 to 30, so your margin requirement is 1 divided by 30, which is 0.033, which means it’s 3.34%. If leverage is 1 to 50, then it’s 1 divided by 50, which is 0.02, so it’s 2%. Let’s say you want to make a trade worth 50,000 dollars with 1 to 50 leverage.

We know that 1 to 50 leverage is 2% margin; therefore, we need 1,000 dollars to make that 50,000 dollar trade. It’s important to note that margin requirements are not fixed amounts. For example, brokers will fluctuate the margin required depending on factors such as market volatility during a particular time of the day. With regulated brokers, the margin requirements for forex markets stay within the specified amounts during the main trading hours almost always, so it’s nothing to worry about.

Used margin is simply the total of all your required margin to keep all your trades open. In other words, it’s the sum of all required margin being used. For example, we have an account of 50,000 USD and want to trade GBP/USD with a 50,000 USD position which has leverage at 1 to 30. This means the margin required is 3.34%; therefore, the required margin for this 50,000 USD position is 1670 USD.

Let’s say you want to enter another trade while the GBP/USD trade is running. This second trade is a 100,000 USD position which is one standard lot.

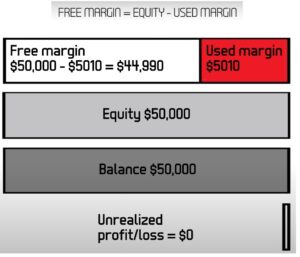

Let’s say this position is to go long USD/CHF, and it’s 1 to 30 leverage, so you will need 3.34% margin. 3.34% of 100,000 USD is 3340 USD, so when you add this 3340 USD to the 1670 USD from the first trade, you get 5010 USD as the total. This total of 5010 USD is the used margin figure.

To understand used margin, we first needed to understand the required margin, which is the position size value multiplied by the margin requirement. It’s important to remember that margin is used from your account equity and not your account balance.

Free Margin Explained

Next, we will go through what free margin is. Since we now know what used margin is, we can easily understand what free margin is. Free margin is the difference between used margin and equity; therefore, it’s simply referring to the equity that’s not tied up in open trade positions. Free margin is also sometimes referred to as usable margin, as it’s the margin that you can use for new positions. Look at the diagram to see how you would work out your free margin based on the example we just used for used margin.

When free margin is zero, new positions cannot be entered. This is simple enough to understand since we went through used margin earlier, so we will now move on to what the term margin level means.

Margin Level Explained

Since we know what used margin is and how to calculate it, we can also understand what the margin level is. The higher the margin level percentage means, the more free margin you have available to trade. We can calculate the margin level using the example from earlier where we had two positions open using 5010 USD in total from a 50,000 USD account.

Let’s say both positions were at breakeven therefore your account equity is the same as your account balance which is 50,000 USD. The margin level would be 50,000 USD divided by 5010 USD which is 9.98 which we multiply by 100 to give 998 percent. 998 percent means the margin level is high; therefore, it should be fine to enter more trades simultaneously.

The lower the margin level percentage figure means the greater the used margin compared to your equity. For many brokers the margin level percentage is limited to no less than 100%. If this is the case with your broker, then you need to be aware of this so you do not use up all your margin. It’s important to know that if any of your open positions go into drawdown, your equity will decrease, impacting your margin level.

Margin Call Level Explained

As we now know what margin level is, we can understand what a margin call level is. This is because the margin call level is when the margin level has reached the limit. Many brokers have a margin call level set at 100%, so a margin call will occur if your margin falls below 100%. This used to be a phone call but these days it usually means your broker will notify you via email to tell you this. The two terms traders need to know are that a margin call level is the threshold limit of the margin level, for example 100%, and the margin call is just the event where your broker takes action.

To help explain how a margin call can happen let’s take a look again at the earlier example where we had a 50,000 USD account and two open positions. The first long position on the GBP/USD for 1670 USD used margin, and the second was long USD/CHF with 3340 USD used margin. Let’s say the first trade stayed at breakeven however the USD/CHF trade goes into drawdown by 4499 pips at 10 dollars per pip. The unrealized loss for that trade is, therefore 44,990 USD. Add 44,990 USD to 1670 USD and you get 46,660 USD which means you will get a margin call if the broker’s margin call level is 100%. Even though you did not close out either of your two trades for a loss, you still had a margin call.

Before being able to enter another trade, you will have to wait to see if the market reverses in your favour or if you can deposit more money into your account, so your equity becomes greater than your used margin. Another option, of course, is to close out existing positions.

Stop-Out Level Explained

Now that you know what a margin call level is you can easily understand what a stop-out level is. A stop-out level in forex trading is when your margin level falls to a percentage level which means one or all of your open trades are closed automatically.

So if your account goes below the margin call level then you will get a stop-out level. This is similar to the margin call level except it’s worse because your open trades must be closed to meet the broker’s margin requirements. If you have more than one position open, the broker will close the position with the largest unrealized loss first, followed by the subsequent biggest unrealized loss until the margin level is above the minimum amount. This is the worst scenario for any trader therefore it’s very important you’re aware of this. Margin trading amplifies your returns for better or worse therefore it’s critical you are aware of margin calculations so you can manage risk.

If you found value in reading this, check out the other posts in the Risk Management section of the website.