Jesse Livermore is the legendary name that stands above the rest in stock trading. Widely recognised as the most important stock operator of the last century, creating a legacy that impacts traders’ ideas today.

We’ll uncover trading secrets from the fascinating book Reminiscences of a Stock Operator by Edwin Lefèvre.

The story is in four main parts: Part 1 reveals his captivating background story, part 2 – How he learns from his mistakes, part 3 – His secret fundamental trading principles, and part 4 – his views on trading psychology.

At his peak in 1929, Jesse Livermore earned a fortune of $100 million, around the same as $1.7 billion in 2023. It’s particularly impressive considering Livermore traded his own capital and didn’t use other people’s money. His story is a crazy rollercoaster of winning and losing fortunes by trading stocks and commodities with high risk.

Part 1 – A fascinating background story

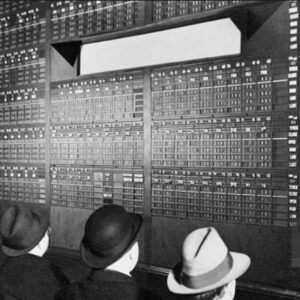

Jesse Livermore began trading at 14, making his first profit of $3.12 and $1000 soon after at 15. Considering $1000 was significant for a young kid, he was ahead of his time in an era of telegrams, and manual stock quote boards.

In today’s world of smartphones, it seems like a world far away from the present. Despite this, Livermore mentions that people and their emotions haven’t changed as fear and greed still drive markets today just like they did decades ago.

Gifted in mental arithmetic, he completed three years of school in one, and his career in Wall Street began at a young age. Straight out of grammar school he landed a quotation-board officer job with a stock brokerage. As soon as prices were shown on the stock tape, he would write them on the market price board for customers to view.

Intrigued by the fluctuating prices, Livermore began analyzing the movements and began to see patterns repeating. He had an incredible memory for numbers and could clearly remember how prices had behaved the previous day.

Livermore soon started to note the stocks he followed in a notebook to record his profits and losses. He used his tape-reading talents to trade at bucket shops and unregulated gambling venues that offered stock market speculating.

Not long after, he was taking far more money through bucket shops than he was earning from his job in the brokerage, so he soon quit the job.

At 21, Livermore had already made a large amount of $25,000, around the same as $700,000 in 2023. But there was a slight problem. Bucket shops became aware of his large winning runs and banned him, forcing him to head to New York.

The markets behaved differently in New York as they were highly regulated, and his strategy from the bucketshops didn’t work. He soon lost all his wealth.

His plan wasn’t working because when his order entered the exchange through his broker, it had triggered at a worse price because of slippage. He could instantly exit positions without price slippage in bucketshops, but he overlooked this aspect of his strategy.

Nevertheless, he built his wealth again by finding more bucket shops and started a Wall Street speculator career by developing his trading principles.

Part 2 – Learning from big mistakes

Through Livermore’s Wall Street career, he viewed losing trades and mistakes as tuition fees. An essential aspect of analyzing his results would be to separate losses from a trader’s error from losses caused by unforeseeable circumstances.

Despite the continuously changing market environment, Livermore recognized how consistent market psychology was. His strategy was developed by identifying market cycle psychology and determining when markets were in a greedy bull or fearful bear phase. One of his favorite books was Extraordinary Popular Delusions and the Madness of Crowds by Charles Mackay, which explores psychology.

Livermore’s unique understanding of timing market cycles helped him enter trends early. He believed a market phase could be found before a market would reflect true value. He cautioned traders against committing to the bullish or bearish side by emphasizing the importance of finding logical entries instead of following general market sentiment.

Part 3 – Jesse Livermore’s Key Trading Principles

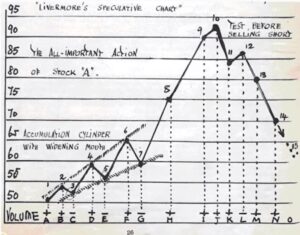

His method mostly centered on evaluating a stock’s price behavior to figure out the line of least resistance. Once he established a stock line of least resistance, he believed prices would sometimes be above or below it while never being too high to go long or too low to go short. He once said, “Suppose the line of least resistance showed a bull movement. I would buy ten thousand bales. If the market went up ten points after, I would take on another ten thousand bales. If the position showed a loss after buying the first ten or two thousand bales, out I’d go.”

Livermore noted that if the price was above the line of least resistance, it had crossed a psychological resistance point, and the momentum would increase to likely push the stock price higher. Essentially, he was describing a breakout of resistance.

Conversely, if a stock price begins to gradually fall with small declines following a gradual rise, it shows a change in the resistance line from ascending to descending. What he’s describing is trend divergence followed by a trend change.

He would ideally buy in an uptrend as he’d look for quick momentum moves with the overall trend. Livermore strongly avoided buying in a declining market while using the price of a stock’s high as a potential profit target.

Typically, looking to buy after a stock has declined is seen as potentially higher value by value investors looking for long-term investments. However, Livermore’s short-term stock trader approach differs greatly from a value investor approach. Additionally, he would only look to enter a trade in a highly liquid stock as he wanted to avoid taking on the risk of entering or exiting at unfavorable prices.

Livermore also took on commodities trading as he thought it was similar to a business venture needing in-depth economics analysis. He attributed commodity price movements mainly to the effects of the market’s supply and demand. Also, he applied his price tape predictions while paying attention to commodity macroeconomic trends.

Part 4 – Jesse Livermore’s approach to trading psychology

Surprisingly, he valued the importance of physical fitness for traders despite fitness not being as mainstream in his era as it is today. Keeping active gave him a competitive advantage because a healthier body leads to a healthier mind.

He tells traders to follow a plan that doesn’t necessarily require a very high win rate. The book also mentions that traders do not always need to be in a trade because finding rational reasons to always buy or sell would be impossible. He emphasized the importance of basing trade ideas on facts while warning against believing that surprise events cannot occur. No matter how certain and great a trade setup might seem, no trade is a certain winner, as unexpected events can sometimes happen.

When trading, Livermore believed successful traders must deal with fear and hope as they are major emotional states. He mentions how technology changes, but emotions remain; therefore, understanding trading psychology is essential. The cycles of fear and greed continue throughout the markets; therefore, traders must adapt dynamically to market conditions.

He explains how making decisions based on stock tips and following the mainstream media is not a wise idea. Livermore mentions that thinking independently is critical, especially when trying to be influenced by charismatic individuals.

Although highly successful, he lost a fortune many times, mainly due to his failure to obey his standards. He started losing his way following a significant financial loss and a divorce. Tragically, in 1940, Livermore fatally shot himself in the cloakroom of The Sherry-Netherlands hotel in New York at the age of 63. A sad end to an extraordinary life. Unfortunately, even with great wealth and trading discipline, we sometimes cannot control our emotions.

He left this timeless saying: “Wall Street has never changed. Wealth comes and goes, stocks come and go, but Wall Street won’t change because human nature will never change.” Today, Jesse Livermore’s legacy lives on through the work of plenty of traders inspired by his insights. If you enjoyed reading this make sure you check out more content from the blog.